Financial Advisors in Spartanburg and Greenville

Excel in Retirement With Confidence

Could your financial life use some direction? Clients Excel Financial Planning can help through strategic planning, tailored approaches, and a unique planning process.

Your Path To Financial Success Starts Here

We're more than just financial advisors— we're a team equipped to help you get to the finish line. Our customized planning process includes services that cover these key milestones:

grow

Prepare for the future by putting your hard-earned assets to work.

preserve

Protect assets that can help you live the retirement you’ve always imagined.

give

Provide for the people and causes you care about the most.

No matter what your goals are, founder and financial advisor David C. Treece can guide you on your journey. He serves individuals, families, retirees and near-retirees in South Carolina and beyond. Schedule a complimentary consultation and let’s get you on the road to financial and retirement success.

holistic financial planning

The Financial Planning Wheel

At our firm, we see

financial planning as a “wheel” supported by eight spokes. The spokes are key financial areas that can support an overall, comprehensive plan to drive your growth, preservation and legacy wishes.

1

retirement income planning

Plan your retirement income streams.

2

investment planning

Manage your overall portfolio.

3

insurance planning

Protection from life’s uncertainties.

4

healthcare planning

Put needed coverage in place.

5

long-term care planning

Plan for future care needs.

6

social security planning

Determine options and timing.

7

tax minimization planning

Mitigate tax burdens.

8

legacy planning

Leave a legacy.

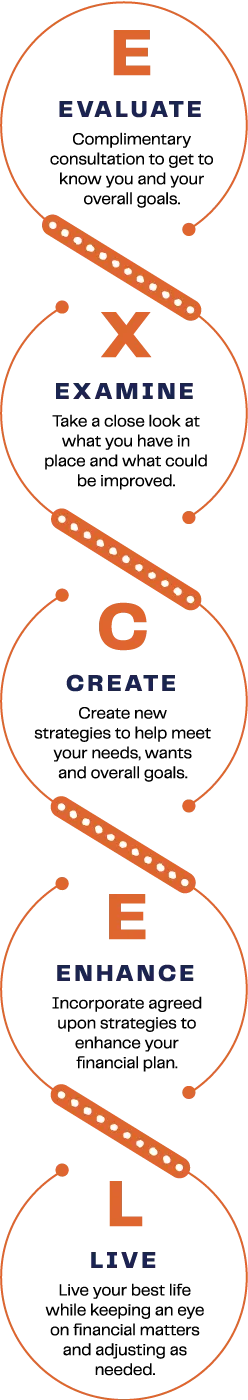

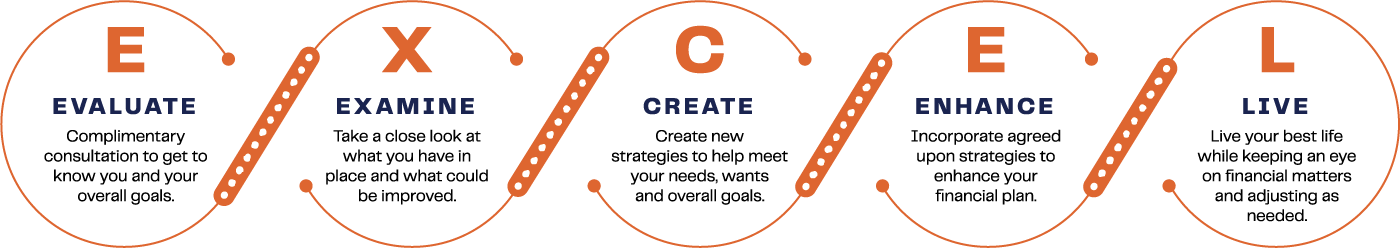

Excel through Retirement Planning

At Clients Excel, we help clients gain momentum in their financial lives through our five-step EXCEL Process. It’s designed to uncover important details about you, your goals and keep us on track.

What's Your Risk Number?

Find out in 5 minutes. Capture your risk tolerance and see if your portfolio fits you.

5 Simple Steps to a Successful Retirement

Make Your Retirement a Blockbuster

Do you have doubts about your ability to reach your retirement goals? Are you less than confident about certain aspects of your retirement strategy? Here’s the good news…there’s always time to adjust your plan and get back on track. You can take your retirement strategy from flop to blockbuster with these simple strategies.

Custodial Services with Charles Schwab®

Charles Schwab & Co., Inc. is a provider of financial services. Founded in 1971, the firm offers brokerage, benefits outsourcing, and other financial products and services to more than 38 million individuals and institutions, as well as through over 16,000 financial intermediary firms. For more information about Charles Schwab, visit https://www.schwab.com.

1. Charles Schwab provides clearing, custody, or other brokerage services for accounts managed by Clients Excel.

2. Working with Charles Schwab gives access to a range of institutional products and services at competitive costs to help serve client needs. However, fees and expenses may vary based on account type, transaction volume, and other factors—please review the custodian's fee schedule for details.

3. Through a custodial relationship with Charles Schwab, clients receive a consolidated statement each month reflecting investment positions and transactions in their Charles Schwab account.

Our firm values the support provided by qualified custodians to help deliver client services. While we recommend Charles Schwab & Co., Inc. as our preferred custodian for its integration with our systems, clients may select from other qualified custodians. Using a non-recommended custodian may limit our ability to monitor or manage accounts effectively. Our firm may receive non-cash benefits from custodians, such as research or event support, which could present conflicts of interest—these are disclosed in Item 12 of our Form ADV Part 2A.

Please note: We are not affiliated with Charles Schwab & Co., Inc., and they do not endorse or recommend our advisory services. Assets are held by the qualified custodian, and we are deemed to have custody in limited cases. All investments involve risk, including the potential loss of principal, and custodial arrangements do not guarantee performance or protect against losses.